Option pricing - Exotic Options - Pricing Asian, Look backs, Barriers, Chooser Options using simulators - FinanceTrainingCourse.com

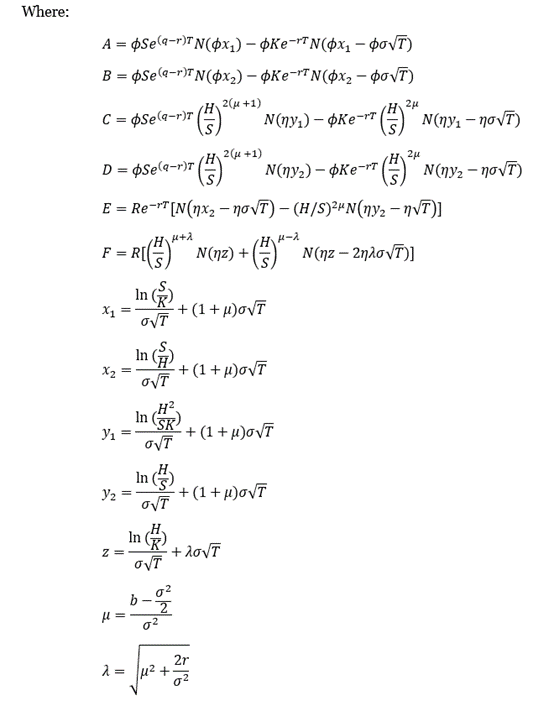

SciELO - Brasil - Use of radial basis functions for meshless numerical solutions applied to financial engineering barrier options Use of radial basis functions for meshless numerical solutions applied to financial engineering

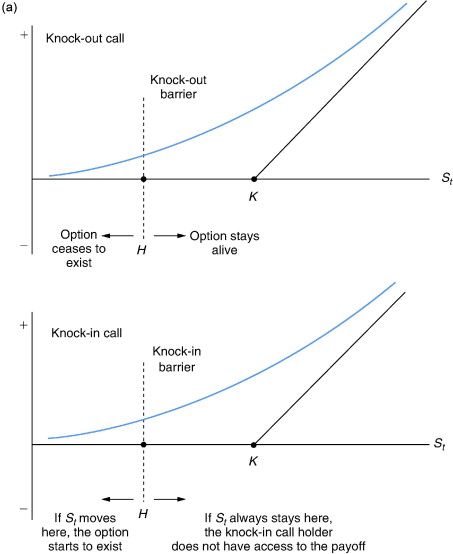

Barrier option valuation with binomial model Binomial model Barrier options Formulas Application. - ppt download

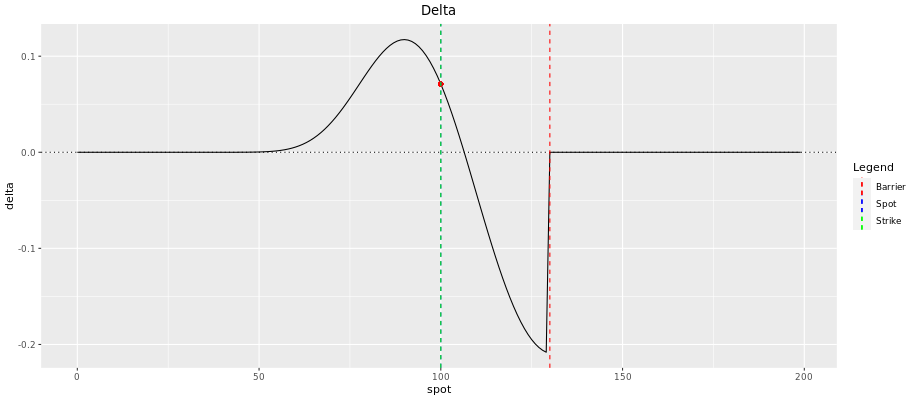

black scholes - Derivative: Delta of a Down and Out Call Option with Barrier=Debt(K) - Quantitative Finance Stack Exchange

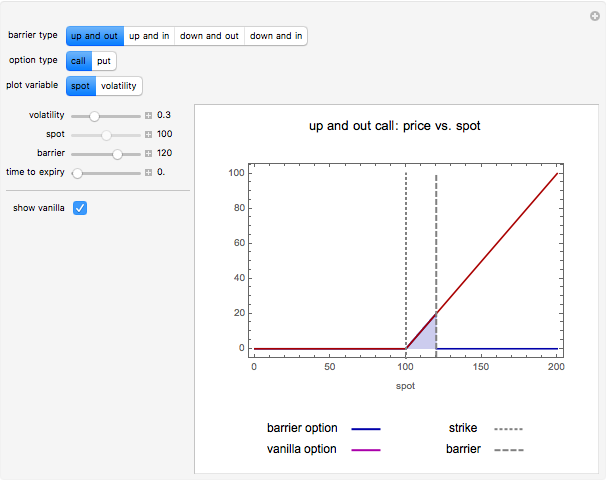

programming - Why does the closed formula result for a Barrier option price deviate so strongly from the Monte Carlo approximation? - Quantitative Finance Stack Exchange

:max_bytes(150000):strip_icc()/dotdash-INV-final-Rebate-Barrier-Option-May-2021-01-3bb9f7473625446a9bf419f8bc7ea49d.jpg)