OECD/G20 Base Erosion and Profit Shifting Project Preventing the Granting of Treaty Benefits in Inappropriate Circumstances, Action 6 - 2015 Final Report (Paperback) - Walmart.com

OECD/G20 Base Erosion and Profit Shifting Project Mandatory Disclosure Rules, Action 12 - 2015 Final Report (Paperback) | The Ripped Bodice

Base Erosion and Profit Shifting ((BEPS) | Deloitte | Tax Services | International Tax |Insights | Article

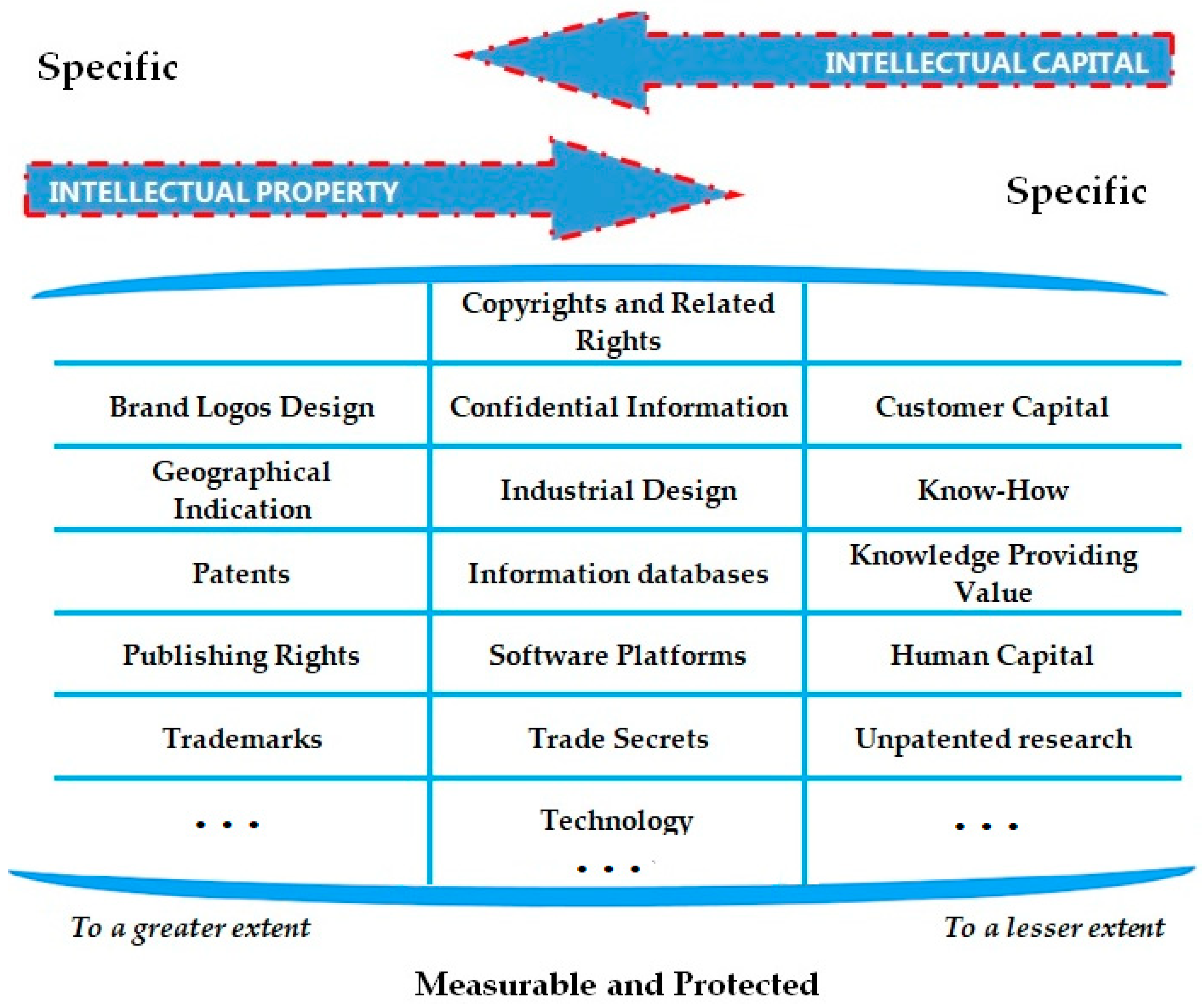

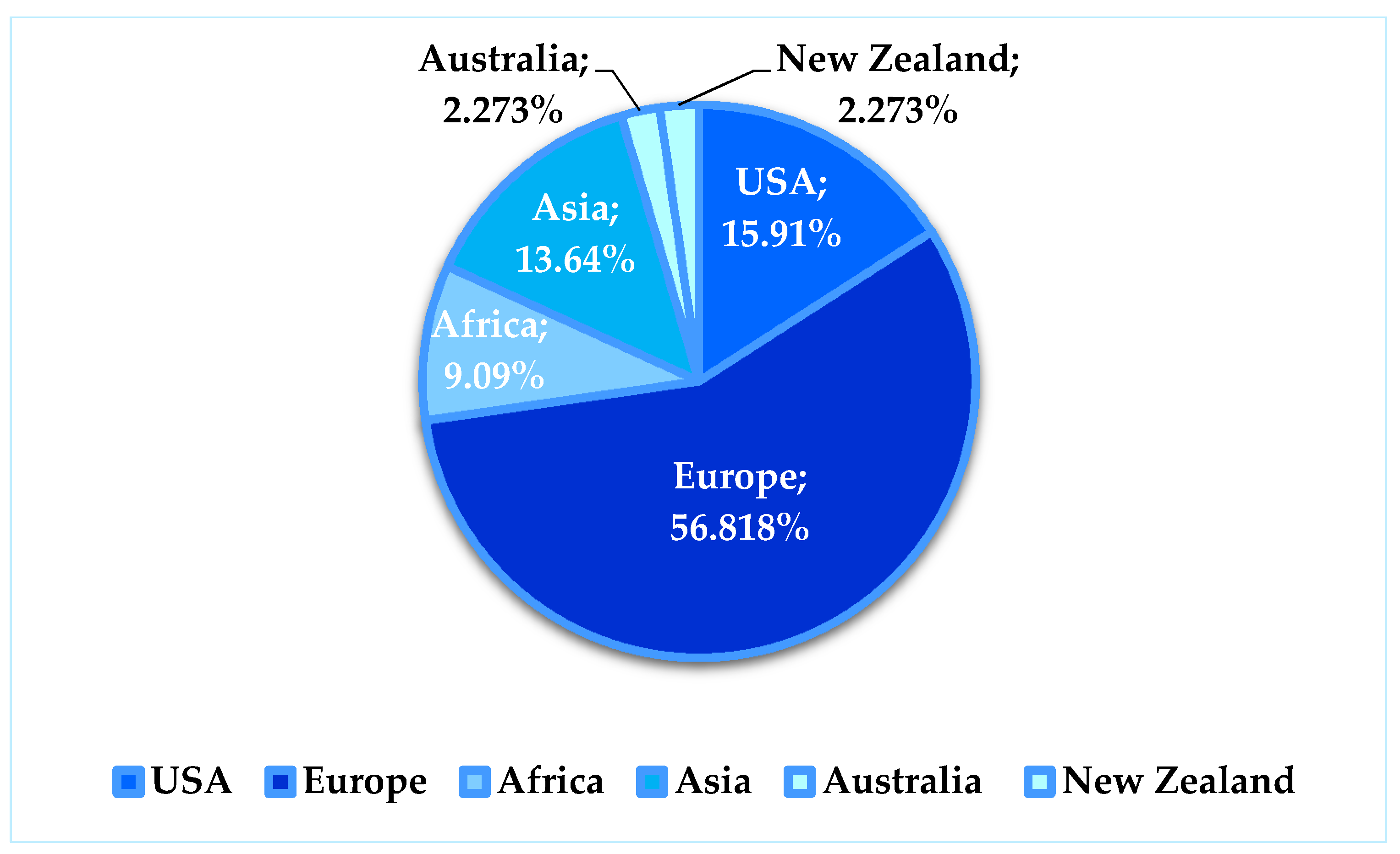

Sustainability | Free Full-Text | Sustainability Assessment: Does the OECD/G20 Inclusive Framework for BEPS (Base Erosion and Profit Shifting Project) Put an End to Disputes Over The Recognition and Measurement of Intellectual

OECD/G20 Base Erosion and Profit Shifting Project Designing Effective Controlled Foreign Company Rules, Action 3 - 2015 Final Report (Paperback) | The Ripped Bodice

Sustainability | Free Full-Text | Sustainability Assessment: Does the OECD/G20 Inclusive Framework for BEPS (Base Erosion and Profit Shifting Project) Put an End to Disputes Over The Recognition and Measurement of Intellectual