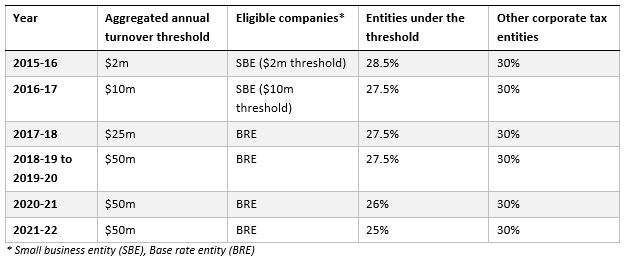

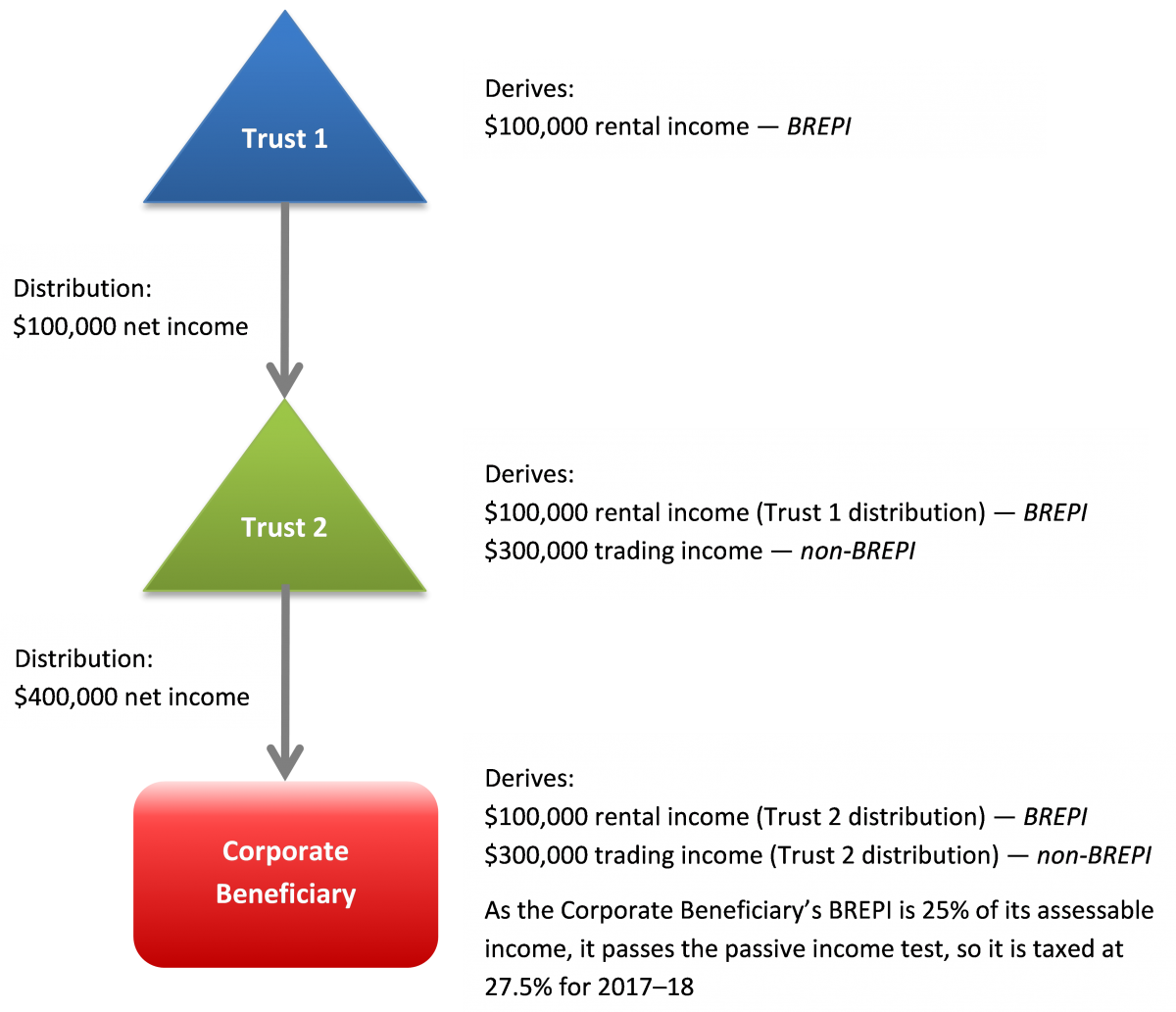

Base Rate Entity concept explained: How to get a 27.5% tax rate? | A "Base Rate Entity" pays tax 27.5% instead of 30%. Find out how it works and if your business

Base Rate Entity concept explained: How to get a 27.5% tax rate? | A "Base Rate Entity" pays tax 27.5% instead of 30%. Find out how it works and if your business