statistical significance - How to calculate t-statistic for one day abnormal return (event study)? - Cross Validated

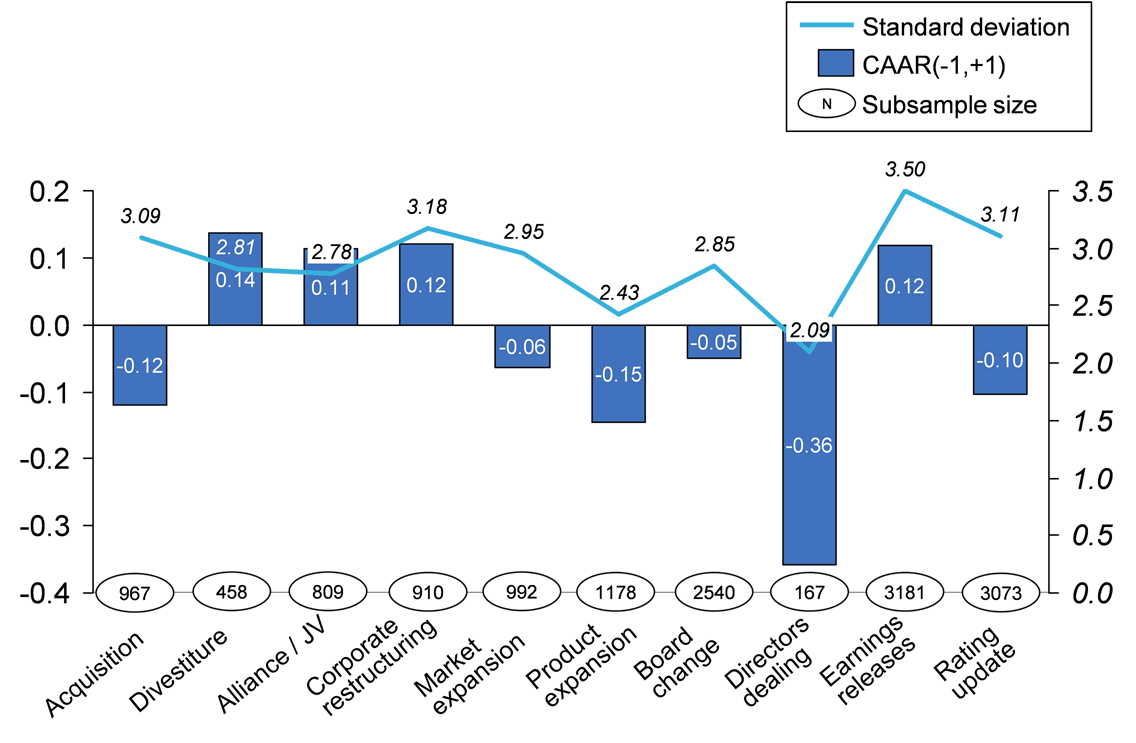

View of Modeling and Estimation of Cumulative Abnormal Return using VECM | Financial Risk and Management Reviews

finance - How to calculate the BHAR (Buy-and-Hold Abnormal Returns)? - Quantitative Finance Stack Exchange

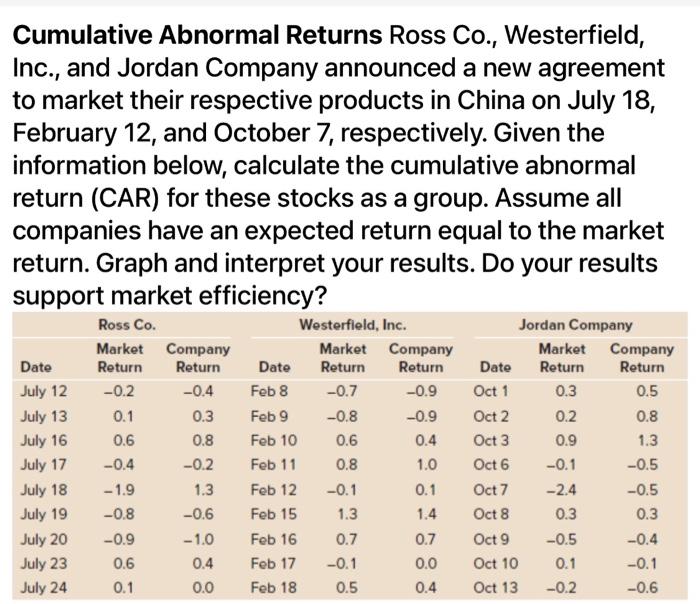

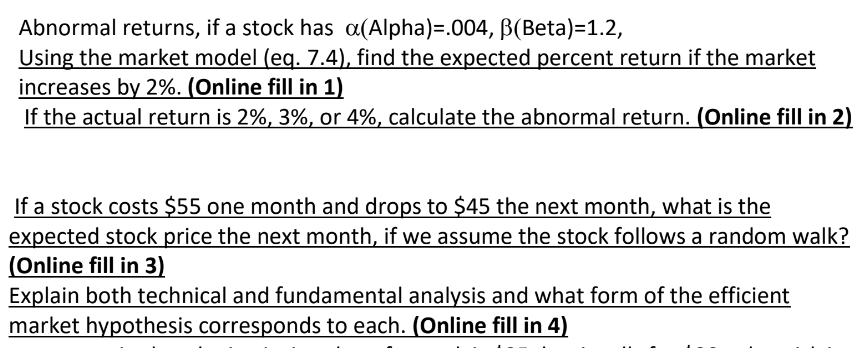

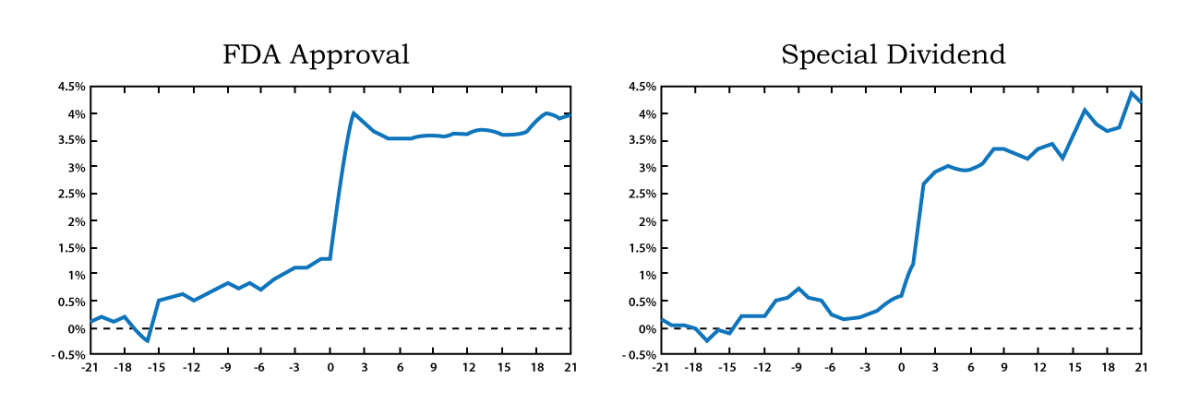

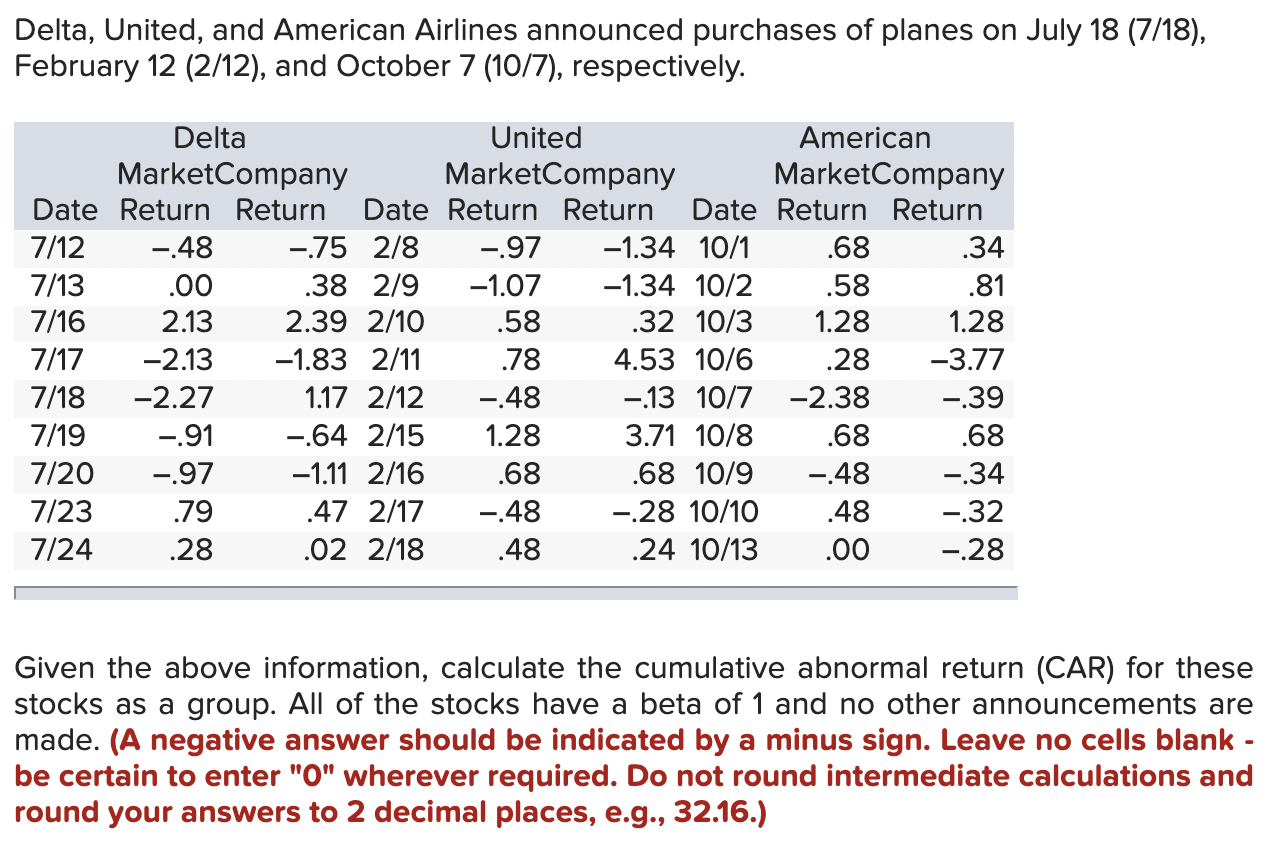

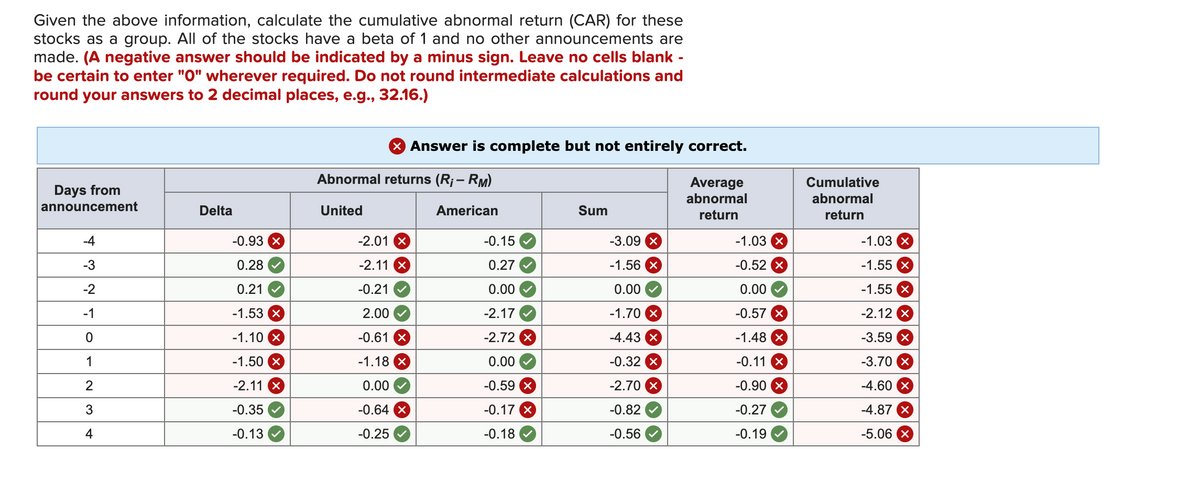

A pedagogical Excel application of cumulative abnormal returns to Hewlett-Packard Company's takeover of 3Com Corporation