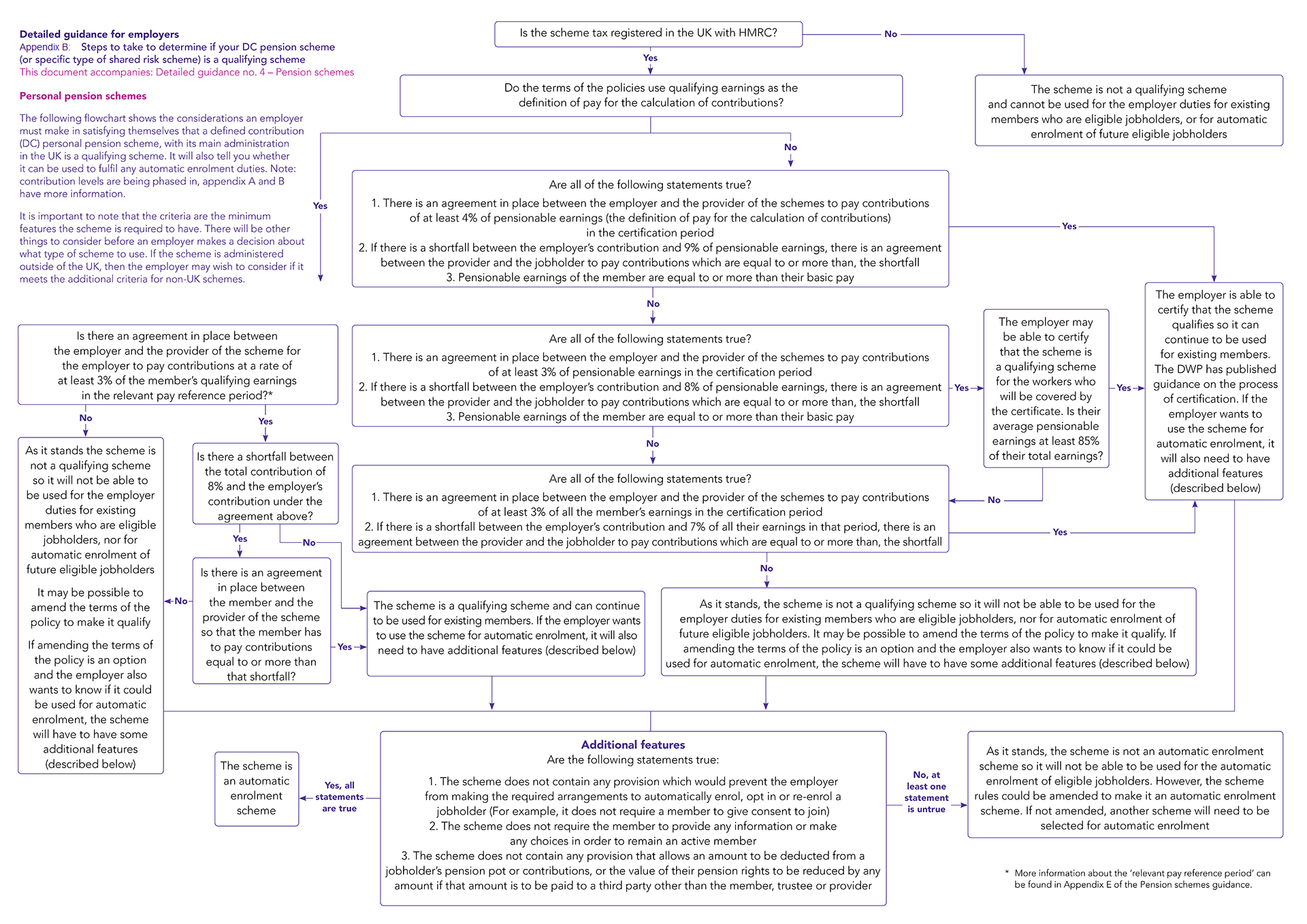

Pension schemes under the employer duties - automatic enrolment detailed guidance for employers | The Pensions Regulator

Pension schemes under the employer duties - automatic enrolment detailed guidance for employers | The Pensions Regulator

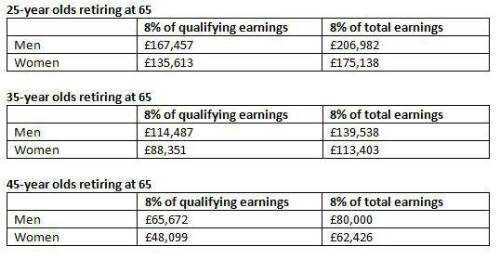

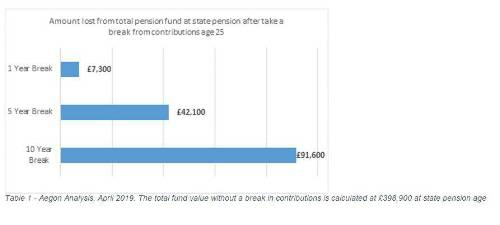

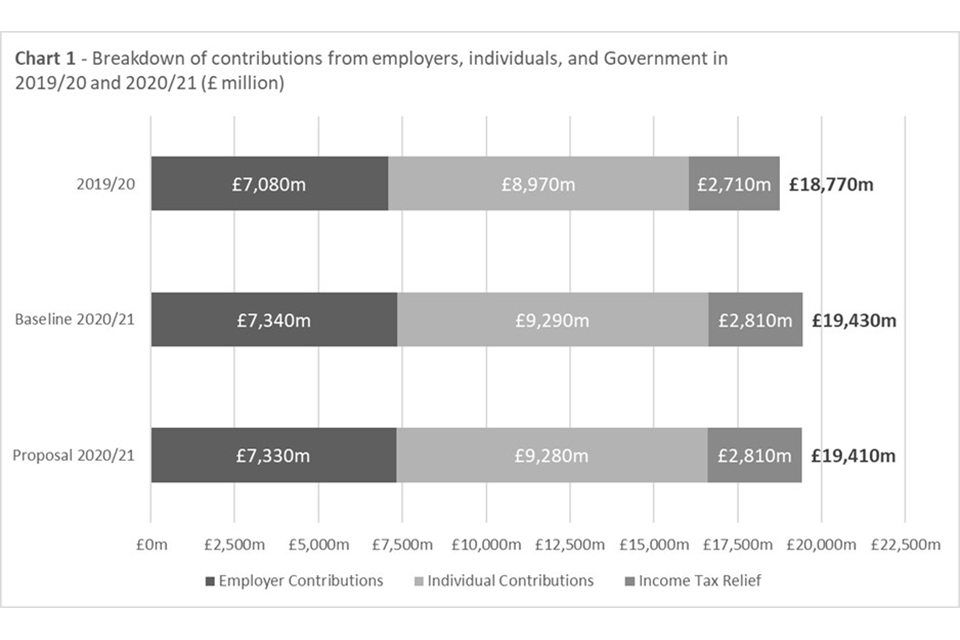

Review of the automatic enrolment earnings trigger and qualifying earnings band for 2020/21: supporting analysis - GOV.UK