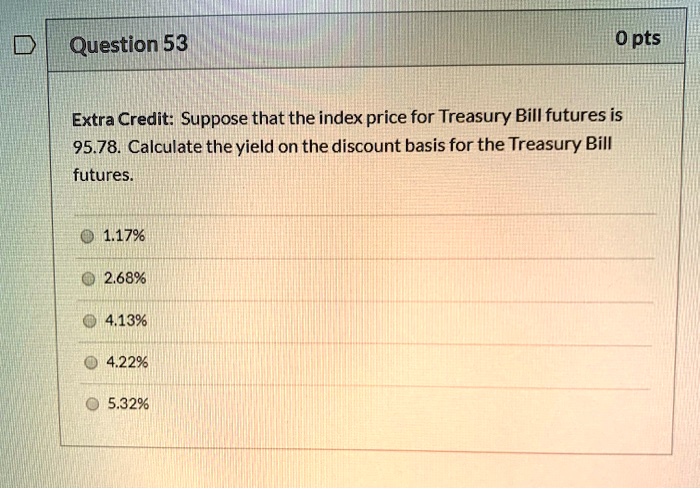

Bond Pricing P B =Price of the bond C t = interest or coupon payments T= number of periods to maturity r= semi-annual discount rate or the semi-annual. - ppt download

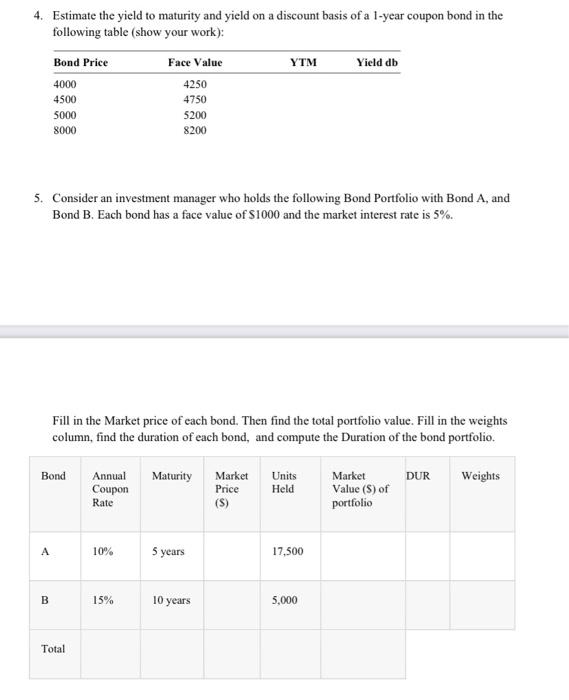

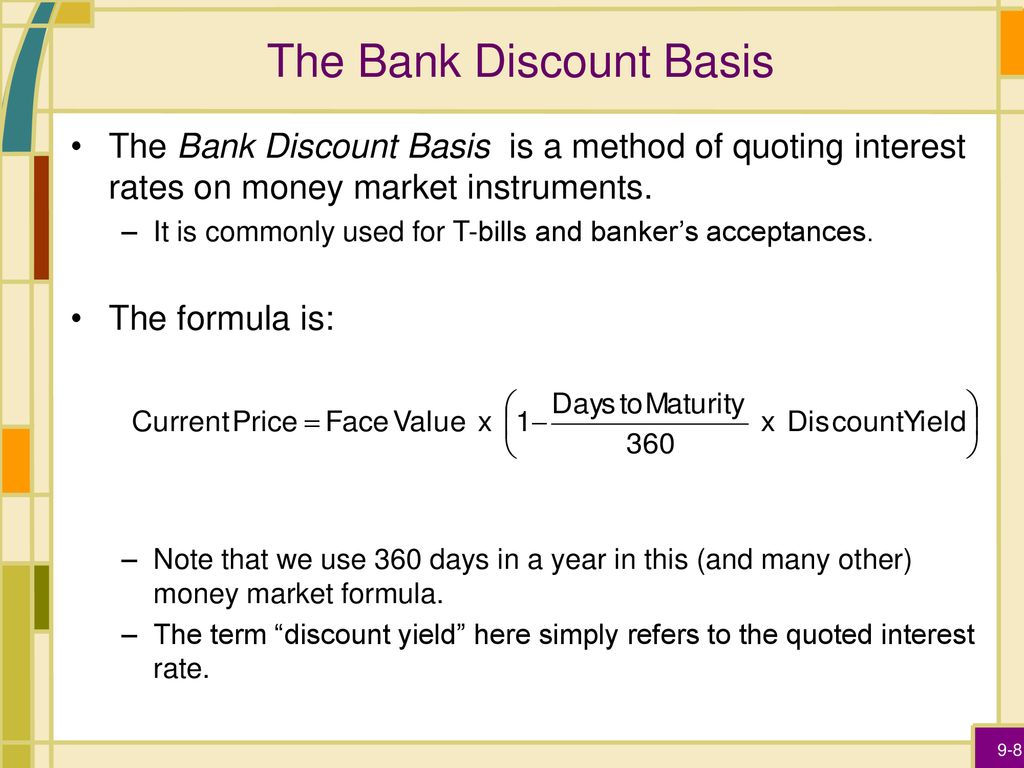

calculate and interpret the bank discount yield, holding period yield, effective annual yield, - YouTube

:max_bytes(150000):strip_icc()/terms_b_bond-yield_FINAL-74bdaeeac8754562855f3aa85ba153c9.png)

:max_bytes(150000):strip_icc()/dotdash_INV_final_Discount_Yield_Jan_2021-01-fc704294a32348a7bc00e0fc7652b88e.jpg)