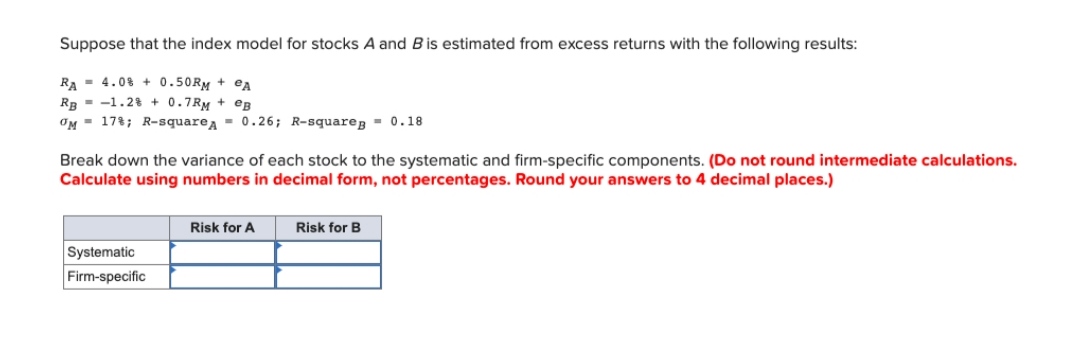

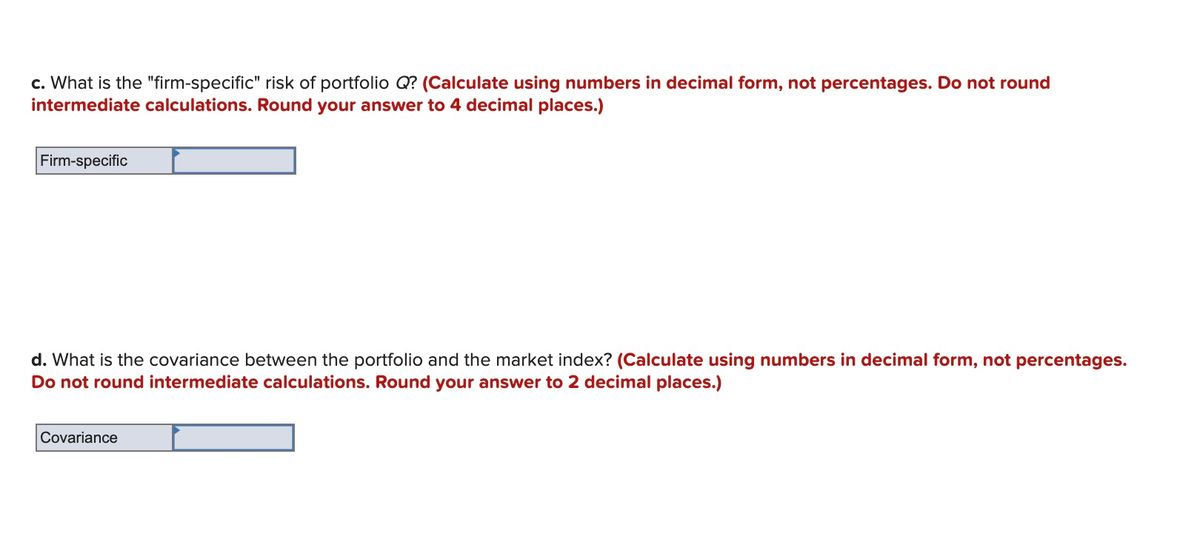

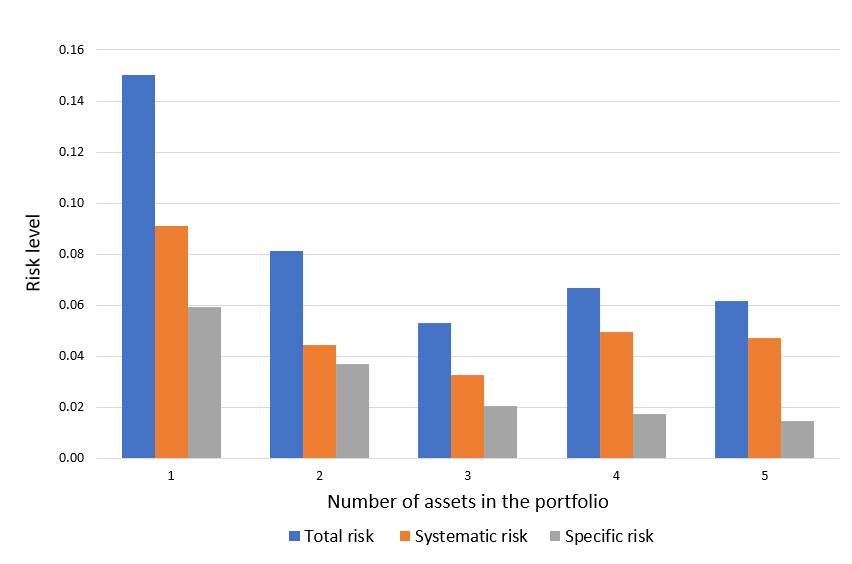

SOLVED: Suppose that the index model for stocks A and B is estimated from excess returns with the following results RA = 2.8% + 1.00RM + eA RB=-1.0%+ 1.30RM +eB oM=18%;R-squareA=0.27;R-squareB =0.13

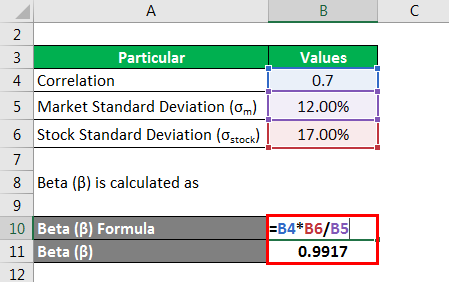

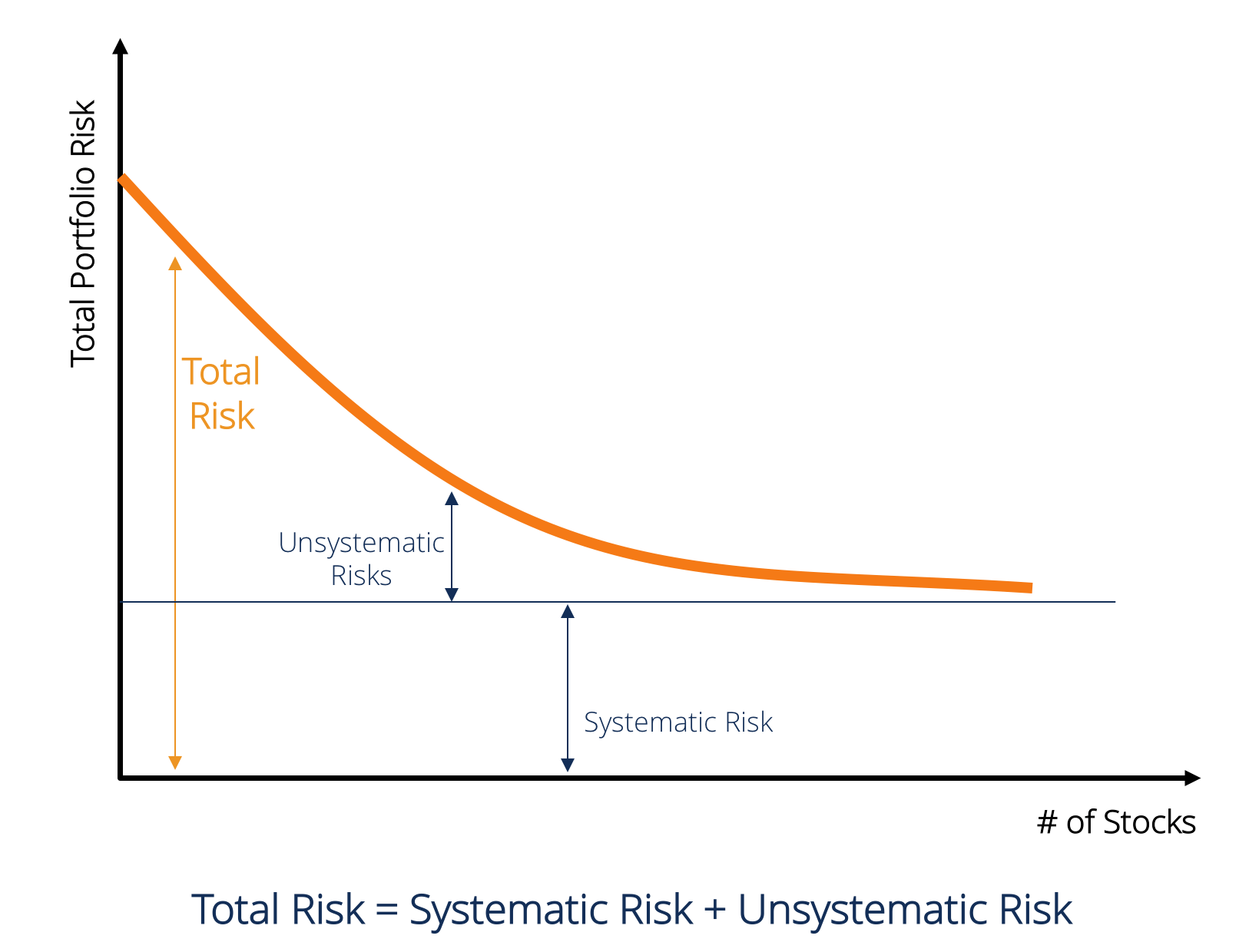

What is Systematic Risk (aka Beta)? How to Calculate Beta of a Stock? - Everything You Need to Know.

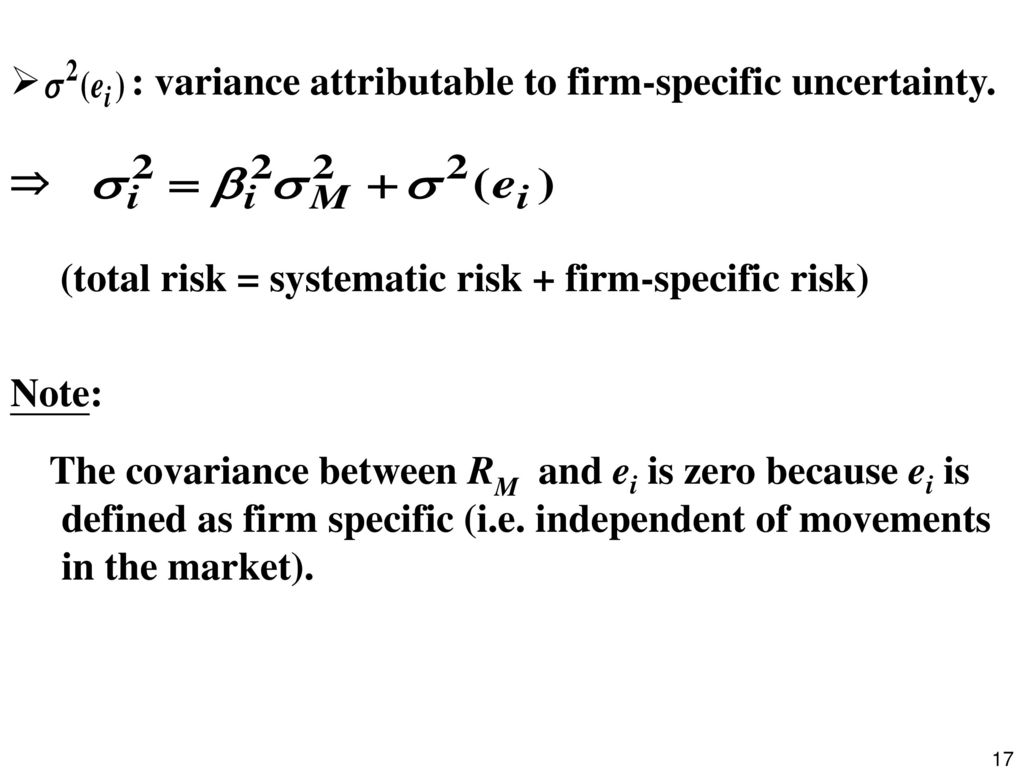

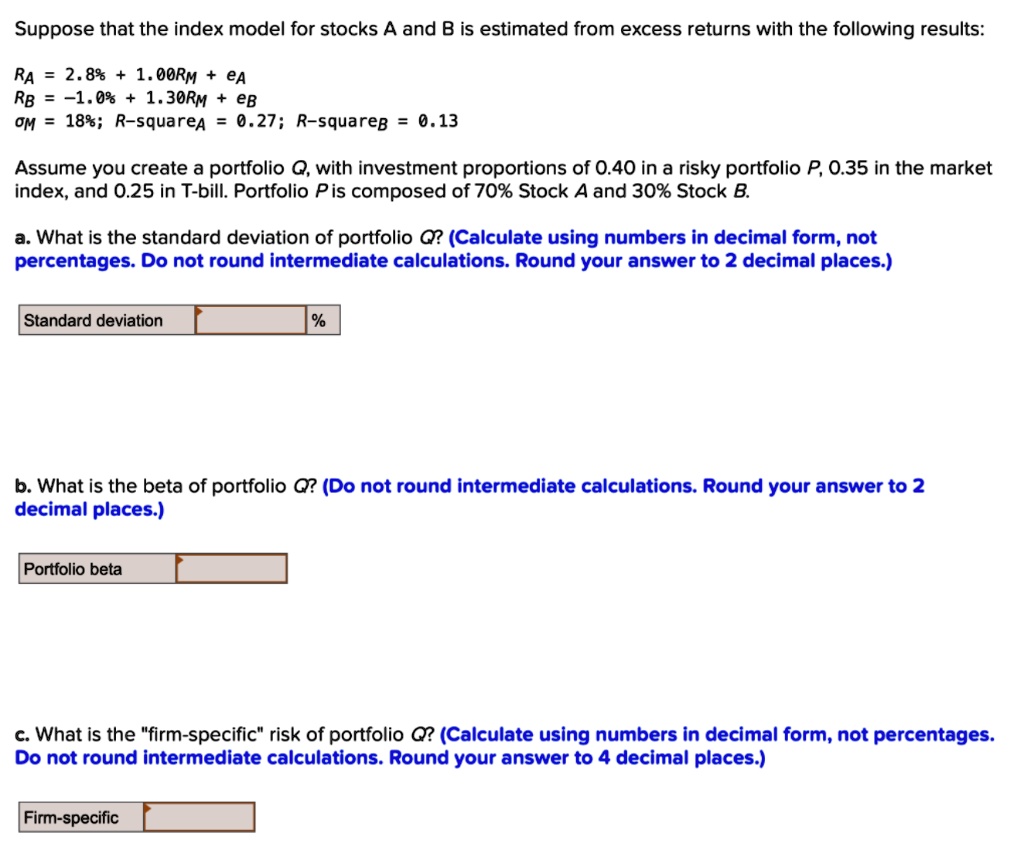

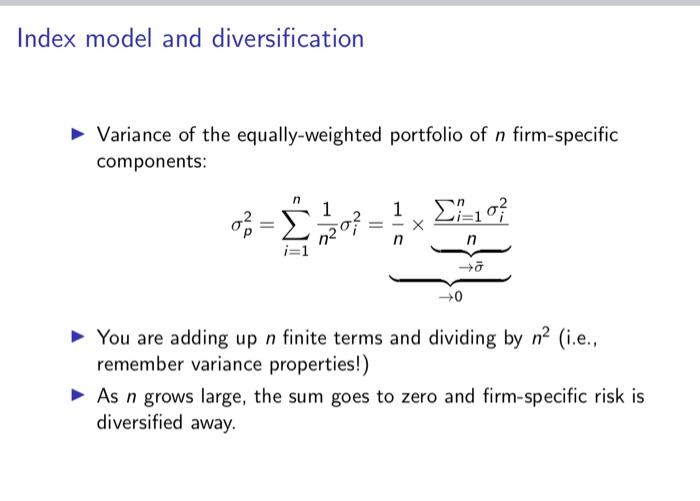

SOLVED: II: The single-index model for stock i is Ii-If== 2(rM-Tf) + ei: The single-index model for stock j is Ij-Tf= 2(rM- Tf) + ej: The standard deviation of the stock market

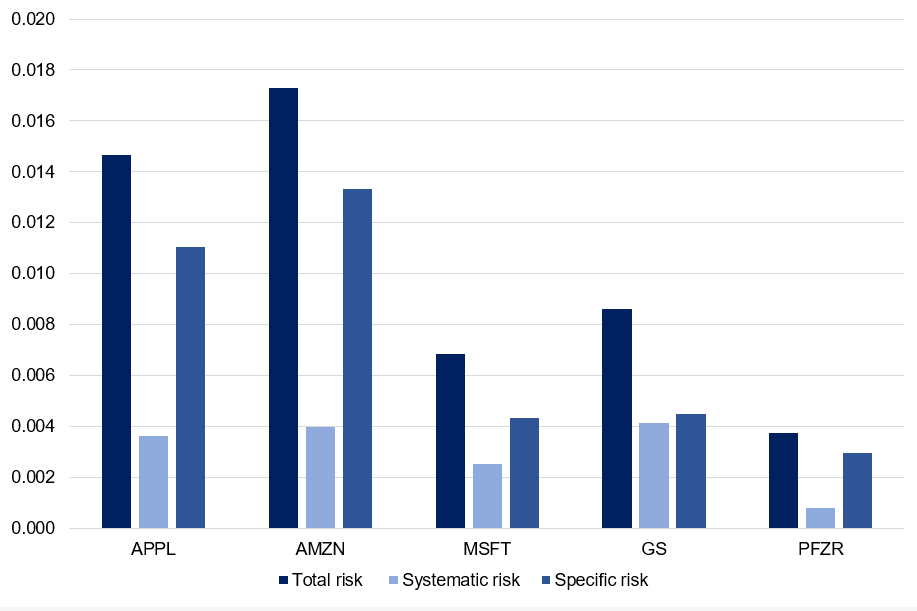

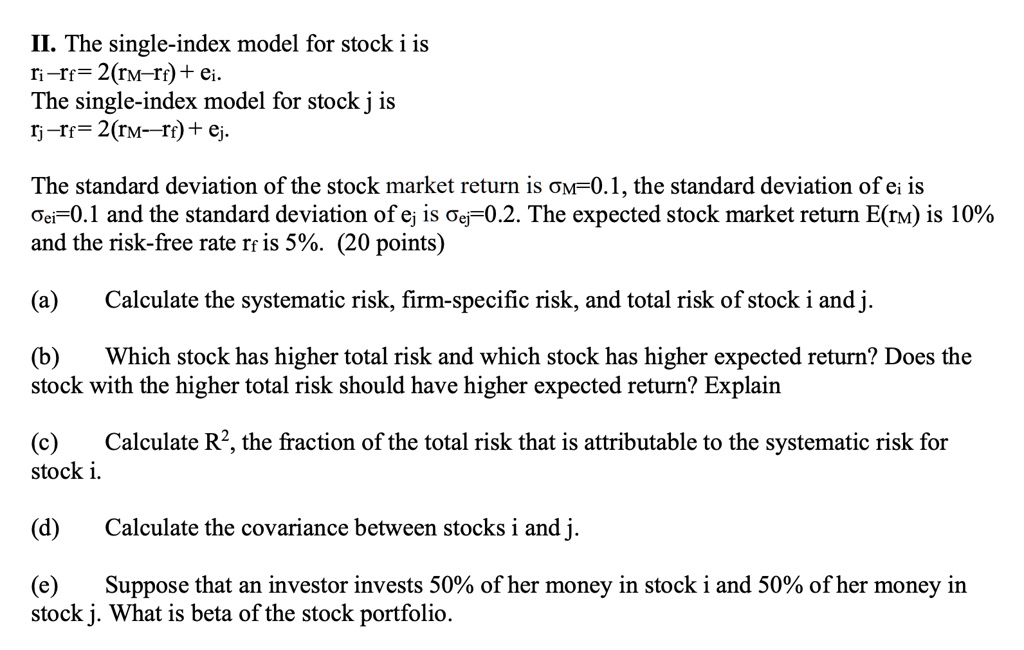

How to Calculate Portfolio Risk From Scratch (Examples Included) - Fervent | Finance Courses, Investing Courses

7.1 A SINGLE-FACTOR SECURITY MARKET Input list (portfolio selection) ◦ N estimates of expected returns ◦ N estimates of variance ◦ n(n-1)/2 estimates. - ppt download

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)